Most landlords require new tenants to pay the value of one month’s rent as a security deposit. However, this amount may not always be able to cover the cost of property damage or unpaid rent.

It’s important to be prepared for these kinds of issues so that you can handle the situation smoothly and confidently.

So, what should a landlord do when a security deposit won’t cover the cost of damages or unpaid rent? Keep reading to find out!

Below are some strategies landlords can use to mitigate or solve this issue.

Screen Prospective Tenants

Developing an effective tenant screening process is vital to limiting property damage. When you screen tenants, you can achieve peace of mind knowing you have responsible long-term renters in your rental space. When you properly screen renters, you can avoid the risk of renting to individuals without reliable income or those with a history of property damage.

Conduct Regular Property Inspections

Performing property inspections will help you keep track of your rental property’s appearance and physical condition. Schedule consistent property inspections and include details about them in your lease agreement, but see to it that your renters continue to access quiet enjoyment while occupying your rental unit.

Before conducting a property inspection, give notice to your renters that adheres to state regulations. This provides time for the renters to arrange their schedules if they want to be present for the inspection or not.

When conducting property inspections, keep an eye out for the following:

- Pet stains

- Unwelcome odors

- Dents, holes, and scratches on walls, floors, ceilings, and doors

- Signs of pests and water damage

Schedule a Final Walkthrough

Before a tenant moves out of the unit, conduct a property walkthrough with them. This will help you monitor any property damage and estimate repair charges that may be deducted from the security deposit to maintain the rental. Give your tenants a detailed list of the property damage so they can opt to arrange repairs before moving out of the unit.

Reach Out to Your Former Tenant

After a tenancy expires, the landlord must return the security deposit to the renters. But if damage beyond wear and tear is discovered, the cost will be deducted from the tenant’s security deposit. However, it’s important to remember that tenants must know why their landlord made deductions and their dollar amount.

Landlords must send a letter to their renter indicating how much of the security deposit is being withheld. We recommend listing each reason for a deduction, such as cleaning fees or repair costs, with their dollar amount. This will ensure that everything is clearly communicated so the tenant can gain an understanding of the deductions being made.

If the cost of repairs is higher than the security deposit amount, you can send a demand letter to the renter indicating the amount the renter still owes.

Send a Demand Letter

When you’re faced with a situation where the repair costs or unpaid rent exceed the security deposit amount, you must send a demand letter to the renter. This letter should contain information such as the amount the renter still owes.

When sending a demand letter, include the same information you would when telling your tenant about security deposit deductions in addition to the payment deadline. This will mitigate confusion and ensure the renter knows how much and when to pay the money they owe.

Make sure you include your contact information so the tenant can reach out if they have questions or issues regarding the deductions.

Consider Small Claims Court

Even if you send the renter a demand letter, you still run the risk of it being ignored. When this happens, you can seek help from a small claims court. Before picking this option, be aware of its benefits and drawbacks, some of which are detailed below.

Considerations to Make Before Going to Small Claims Court

Time Commitment

Are you a busy person? Filing a case and preparing documents for court takes time. When you pursue small claims court, you need to be able to present your evidence, spend time following court processes, and attend a hearing. Additionally, you will need to pay a filing fee at small claims court regardless of whether you win the case.

The Renter’s Finances

Are you prepared to wait to collect your money? Even if a landlord wins in small claims court, a renter may not have enough money to pay the amount they owe. This means you may be unable to collect the money owed or have to wait until the renter is in a better financial situation.

Evidence

When you’re in small claims court, you’ll need to have your evidence prepared. This means gathering documented proof in support of your case. You should be able to show documentation indicating the state of the rental immediately after the tenant moved out and all expenses associated with fixing the damages and charges for unpaid rent.

Countersuits

When you file a case in small claims court, your tenant can respond with a countersuit. As such, being prepared to defend your case in court is crucial.

Bottom Line

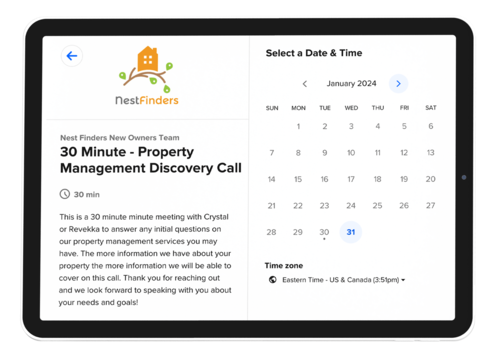

Even when a security deposit won’t cover unpaid rent or costs associated with property damage, there are strategies landlords can use to protect their investments. If you want to reduce your stress and maximize your ROI, reach out to Nest Finders Property Management!

Our expert team is ready to turn your investment goals into a reality!