Jacksonville and St. Augustine Rental Market Trends: November 2024

A Message from Our Broker:

Unlike the blog image that was created by AI, this blog is human written and we hope it provides you insight to the NE Florida Rental market Trends.

The holiday slowdown is in full swing. Like many industries, the Jacksonville and St Augustine rental markets experience seasonality, which is evident in the latest data from the MLS. Unfortunately, this marks the beginning of what is likely a downward trend that may persist until the spring season sparks renewed activity in the rental market for 2025.

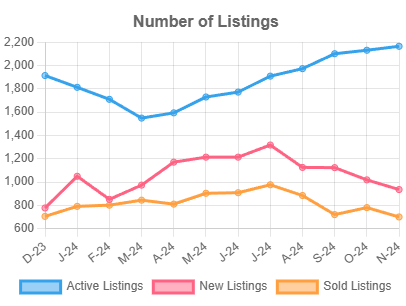

Active Rental Listings:

Active rental listings have continued their steady upward trend through November, with new listings entering the market significantly outpacing the number of properties being sold or rented.

This pattern has remained consistent throughout the year. As the winter season sets in, we can expect a decline in new listings, but sold and rented listings are likely to slow proportionally. Active listings are unlikely to decrease again until February or March.

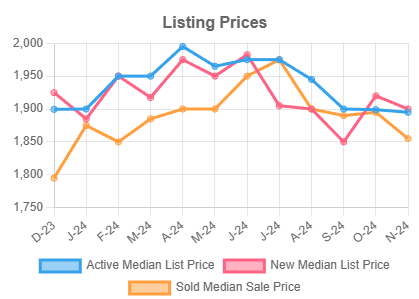

Listing Rental Price:

As anticipated, the Active Median Rental List Price experienced a slight decrease in November, a typical market response to elevated inventory levels and extended days on the market. Notably, November marks the first month of 2024 where the Active Median Rental List Price dipped below $1,900 per month. Meanwhile, the Sold (rented) Median Rental Price settled at $1,850, the second-lowest figure recorded this year. The graph below shows this data.

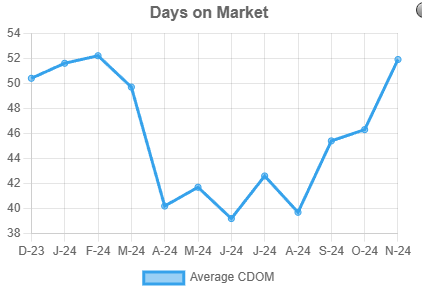

Days On the Market (DOM):

A key metric we monitor, Average Closed Days on Market (DOM), saw a significant spike in November, rising from 46 to 52 days. While large fluctuations in this metric are not uncommon, it serves as a crucial indicator for trends in the coming months. The 52 DOM matches February 2024 for the highest recorded since we began tracking this data in 2021. Current trends suggest that December and January could see even higher averages, potentially approaching 60 days on the market as an average.

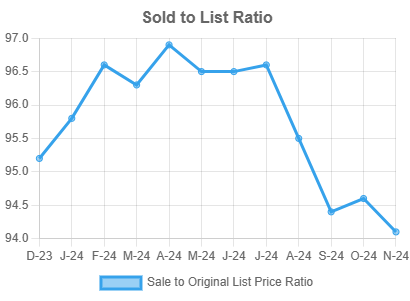

Sold (rented) To List Ratio:

This is what % of rental homes actually leased at compared to what the original listed price (advertised rate) was. While we don’t always focus on this metric, November’s data is particularly noteworthy. The Sold Price to List Price ratio came in at 94.1%, indicating that, on average, rental homes rented for 94% of their original asking price. This is the lowest ratio recorded in 2024 and the lowest since we began tracking this data in 2021. The decline reflects property managers and landlords responding to high vacancy rates by lowering rental rates to boost occupancy. The good news is that, historically, November tends to have the lowest ratio of the year, with improvement typically seen in December and January.

Summary and Closing Thoughts:

Summary and Closing Thoughts:

The data reflects what many property managers are already experiencing in the Jacksonville and St Augustine markets: higher-than-normal vacancy rates, longer days on the market, and the need to adjust pricing, enhance offerings, update homes, to attract renters. While market conditions continue to shift, rental prices remain elevated, and demand has held relatively steady. As we progress through the holiday season, higher vacancy rates are likely to persist, prompting the need for proactive measures such as property improvements or price adjustments, concessions to address the challenges.

Nest Finders is one of the few companies in the area with leasing built into our DNA, after all we started as a specialty tenant finding service for national REITS and developers over 20 years ago, we know the market and marketing. We pay for premium placement, use local staff, showing agents, latest tech and have weekly team meetings on each property.

This data provided is from the North Florida realMLS and I hope that it helps all fellow landlords make better-informed decisions for their rental homes and investments.

Happy Holidays