Welcome to the vibrant world of Jacksonville real estate investing! As a property investor, you are uniquely positioned to tap into a market ripe with opportunities.

Jacksonville, with its thriving economy, diverse neighborhoods, and favorable climate, stands as a beacon for real estate enthusiasts looking to diversify their investment portfolio or secure a steady income stream.

Whether you're new to the game or a seasoned property investor, understanding the various real estate investment strategies available can significantly enhance your success.

Let's delve into the real estate investment strategies you need to know in Jacksonville.

Real Estate Investment Trusts (REITs)

If you're looking to invest in real estate without the hassle of managing properties, Real Estate Investment Trusts (REITs) might be your best bet.

REITs allow you to invest in a diversified portfolio of real estate assets, including commercial properties and residential real estate, without owning them directly.

In Jacksonville, REITs are a popular choice for real estate investors seeking exposure to the real estate market with the flexibility of buying and selling shares like stocks.

Real estate investments like REITs generate income through rent collection and property sales, distributing at least 90% of taxable income to shareholders in the form of dividends. This makes them an attractive option for those seeking regular income without direct property management responsibilities.

Additionally, Jacksonville's growing population and economic development make it a promising market for real estate investment trusts, as these factors contribute to the appreciation of property values and rental incomes.

Direct Real Estate Investment Strategies

Jacksonville offers diverse options for direct investment to suit various investor profiles and goals. Here are some strategies to consider:

Buy-and-Hold Strategy: Focuses on long-term appreciation and rental income, ideal for investors looking to build wealth over time.

Fix-and-Flip Ventures: Aimed at quick profits by purchasing, renovating, and reselling properties in a short timeframe.

BRRRR Method:

Buy properties below market value.

Rehab to increase property value.

Rent out to generate income.

Refinance to recoup the investment.

Repeat the process for continuous growth.

**Particularly effective in Jacksonville's rising market with increasing property values and rental demand**

House Hacking:

Purchase a multi-unit property.

Live in one unit and rent out the others.

Helps cover mortgage payments and provides first-hand property management experience while building equity.

These strategies provide a range of opportunities for both new and seasoned investors in Jacksonville’s dynamic real estate market.

Real Estate Investing

Real estate investing in Jacksonville is about more than just purchasing properties; it's about making informed decisions that align with your financial goals and risk tolerance.

Whether you're investing in residential properties, commercial real estate, or land, understanding local real estate market dynamics is crucial.

Jacksonville's real estate market is characterized by its affordability compared to other major Florida cities like Miami and Tampa. This affordability attracts a steady influx of newcomers, driving demand for housing.

As an investor, you can capitalize on this trend by identifying high-growth neighborhoods with potential for appreciation.

Moreover, Jacksonville boasts a robust rental market, thanks to its growing job sector and influx of young professionals and families. Investing in rental properties can provide a reliable income stream, particularly in areas close to employment hubs and educational institutions.

Commercial Real Estate

Commercial real estate is a significant component of Jacksonville's market landscape. With the city's expanding economy and business-friendly environment, opportunities abound for investors looking to diversify their portfolios with commercial real estate.

From office buildings and shopping centers to industrial warehouses and apartment buildings, Jacksonville's commercial properties sector is thriving.

Investing in commercial properties is a real estate investment strategy that can yield higher returns compared to residential investments, although with a higher level of risk and management complexity.

When considering commercial real estate investments, it's essential to conduct thorough market research and due diligence. Assess factors such as location, tenant demand, and potential for future development.

Jacksonville's downtown revitalization projects and infrastructure improvements make commercial real estate a particularly enticing option for forward-thinking investors.

Residential Real Estate Opportunities

Jacksonville's residential real estate market provides a fertile ground for property owners and real estate investors alike. The city's diverse neighborhoods offer a variety of options from single-family homes to sprawling estates, each presenting unique investment potential.

As demand for housing continues to rise, particularly among first-time buyers and young families, the opportunities for capital appreciation and rental income are significant.

For those considering owning rental properties, focusing on neighborhoods with good schools, low crime rates, and proximity to amenities can enhance both property appreciation and rental demand.

Engaging with a knowledgeable property management company can provide you with insights regarding emerging trends and facilitate strategic acquisitions.

Leveraging Online Real Estate Platforms

In today's digital age, online real estate platforms and real estate crowdfunding platforms have become important tools for investors and real estate investment groups who are looking to expand their reach and diversify their portfolios.

These platforms enable investors to engage in indirect real estate investing, allowing participation in real estate projects and investment groups without the need to manage physical properties.

By leveraging these platforms, you can explore a variety of real estate investing strategies as well as investment properties you are interested in, from crowdfunding for commercial developments to investing in real estate mutual funds.

This approach not only diversifies your investment portfolio but also enables you to access opportunities that might otherwise be out of reach due to geographical or financial constraints.

Strategize Wisely

Jacksonville's real estate market offers a wealth of opportunities for investors seeking to grow their portfolios and achieve financial success. By understanding and implementing the right investment strategies, you can navigate this dynamic market effectively.

Whether you're drawn to the hands-off approach of REITs, the active engagement of property management, or the potential for high returns with commercial real estate, Jacksonville has something to offer everyone.

With the right strategy, you can make the most of Jacksonville's promising real estate landscape and achieve your investment goals.

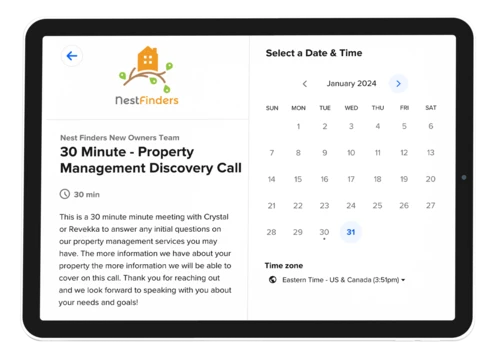

Let our team at Nest Finders be your guide as you explore the exciting possibilities in Jacksonville's real estate market. Reach out today for a free consultation.