As a landlord, understanding Florida security deposit laws is essential to managing your rental property effectively. From collecting a security deposit to navigating deductions and returns, staying compliant with the state's security deposit laws helps maintain a positive landlord-tenant relationship.

In this guide, we’ll cover what Florida landlords need to know to handle a tenant's security deposit correctly while protecting their investment.

Collecting and Storing the Security Deposit

When you lease a rental unit, the process begins with collecting a security deposit amount from the tenant. Under Florida law, landlords must handle these funds carefully to provide financial protection for both parties. You have three main options for storing the deposit:

Separate Interest-Bearing Account: Place the deposit in a separate interest-bearing account with a Florida banking institution. If you choose this option, you must collect interest on the deposit and pay the tenant interest at an annualized average interest rate.

Non-Interest-Bearing Account: Store the deposit in a non-interest-bearing account, as long as the funds remain separate from your personal or business funds.

Surety Bond: Instead of holding the deposit in an account, you may purchase a surety bond through a surety company authorized to operate in Florida. This option offers flexibility but must meet specific legal requirements.

Regardless of the method, landlords must provide a written notice to tenants within 30 days of receiving the deposit. This tenant's written notice should explain how the deposit is held, whether it’s in an interest-bearing bank account, and how interest (if applicable) will be managed.

Allowable Deductions from the Security Deposit

Florida statute outlines specific circumstances under which a landlord can legally deduct from a tenant’s deposit. These allowable deductions include:

Unpaid Rent: If the tenant fails to pay rent or has an early lease termination fee, you can use the deposit to cover unpaid rent.

Damage Beyond Normal Wear and Tear: Repairs for issues beyond normal wear—such as broken appliances, stained carpets, or holes in walls—can be deducted.

Advance Rent or Other Funds Owed: You may use the deposit to recover unpaid utility bills or other charges outlined in the rental agreement.

To avoid accusations of unfair deductions, conduct a walk-through inspection of the rental unit before and after the tenancy prior to returning the deposit. Documenting the property’s condition will help you justify any claims.

Notifying Tenants of Deductions

When you decide to withhold part of the security deposit, Florida law mandates that you notify the tenant within 30 days of the end of his or her tenancy. This landlord’s notice must include:

The specific amount of the deposit being withheld.

A detailed explanation of the deductions.

A statement informing the tenant they have 15 days to object.

Send this initial written notice via certified mail to the tenant’s last known address. If the landlord fails to provide such notice within the required timeframe, the tenant may be entitled to the full security deposit.

Returning the Security Deposit

If there are no deductions, you must return the security deposit within 15 days after the tenancy ends. If deductions are made and the tenant does not object, the remaining deposit must be returned within 30 days after sending the notice.

Ensuring prompt communication with tenants not only keeps you compliant with landlord-tenant law but also helps maintain a positive landlord-tenant relationship.

Handling Tenant Objections

When a tenant objects to your deductions, they must file their dispute within 15 days of receiving the landlord’s claim. Disputes often arise over damage claims or unpaid fees. If unresolved, the matter may need to go to small claims court.

As a landlord, you can strengthen your case by:

Keeping photos or videos of the premises before and after the tenancy.

Retaining receipts for repairs, unpaid bills, or other documented costs.

Providing a clear record of the written lease and related agreements.

Following these steps ensures that your claim is well-supported if the tenant pursues his or her claim in court.

Avoiding Common Mistakes

Mistakes in managing a tenant’s security deposit can lead to legal trouble or strained relationships with tenants. Common pitfalls include:

Failing to Provide Written Notice: If a landlord elects to deduct from the deposit but does not send proper notice, they forfeit their right to retain any part of it.

Misinterpreting Normal Wear and Tear: Be cautious when determining damage. For example, worn carpets or faded paint are considered normal wear and tear, while excessive stains or large holes are not.

Commingling Funds: Deposits must be held separately unless you’ve opted for a surety bond through a surety company.

Missing Deadlines: Florida law has strict deadlines for providing notice and returning deposits. Missing these can expose landlords to legal and financial penalties.

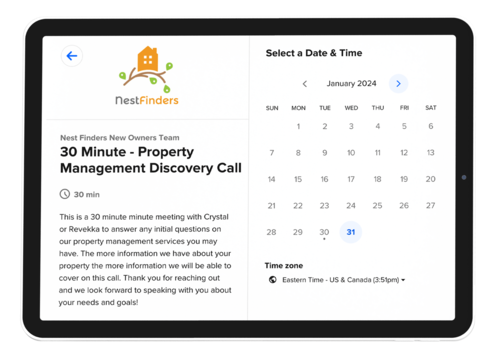

Partnering with a Property Management Company

Navigating Florida security deposit laws can be overwhelming, especially for landlords managing multiple properties. A property management company can simplify the process by ensuring compliance with the state’s security deposit laws, handling tenant communications, and managing the financial aspects of your rental property.

Why Choose Nest Finders?

At Nest Finders, we specialize in helping Florida landlords manage every aspect of their rental business, including security deposits. From preparing a comprehensive lease agreement to conducting walk-through inspections and managing disputes, we handle the details so you don’t have to. Our team stays updated on Florida statute requirements to ensure you remain compliant and avoid unnecessary complications.

If you’re ready to simplify your rental management process, explore our services or visit our Contact Us page to get started. Let us help you protect your investment and maintain a positive relationship with your tenants.

Partner with Nest Finders today, and make managing your rental property a breeze!