According to security deposit laws in Florida, there are no set limits on how much a landlord can charge for a security deposit. However, 87% of renters typically pay a $600 security deposit.

When you charge a security deposit, you are protecting your rental investment. But, you have to continue protecting yourself by handling security deposits according to the laws.

This landlord guide to security deposits will tell you everything you need to know. Keep reading to learn more.

1. Keep Security Deposits in Escrow Accounts

Security deposits might be written out to landlords, but these checks don't necessarily belong to you. A security deposit acts as an insurance policy during the tenancy.

A landlord must hold a security deposit until the end of the lease, but you shouldn't combine the deposit funds with other security deposits or your personal finances.

Keep these deposits in a neutral location, an escrow account is recommended. This way you can easily access the funds when you return the security deposit.

Regardless of the state laws, always consider holding security deposits in their own accounts. You will be required to return the interest accrued to the tenant as well.

The problem with depositing your funds in your personal account is that finances are harder to track and you might accidentally spend the deposit.

In Florida, landlords aren't required to hold deposits in interest-bearing accounts. Landlords can post a surety bond or store tenant deposits in non-interest-yielding accounts.

A full-service property management company can help you decide which handling method is best for you.

2. Written Notice Requirement

Security deposit laws in FL state that landlords have to notify tenants in writing within 30 days after receiving the deposit. The notice has to include the following things:

- Address and name of the financial institution holding the deposit

- If the deposit is being kept in a separate account or not

- The amount of interest accruing, if necessary

If you change the location or terms of the security deposit, you have to notify the tenant in writing within 30 days of the change as well.

3. Return Security Deposits

The Florida statute requires landlords to return a security deposit and any interest accrued within 15 days after a tenant moves out.

A landlord doesn't have to return the security deposit or can deduct amounts from the deposit if the tenant has:

- Unpaid utilities

- Cleaning costs

- Property damages

- Nonpayment of rent

Landlords forfeit their right to make deductions if they do not notify the renter within 30 days of their intention.

If the renter doesn't object to the deductions, the landlord has 30 days after the initial written notice to return a portion, if any is left, to the renter.

How Can Jacksonville Property Managers Help?

There are laws regarding security deposits in Jacksonville, FL that landlords need to know.

Handling security deposits isn't as easy as it sounds. You have to take the time to collect security deposits, place them in the right accounts, and make deductions or return the deposit to the tenant on time.

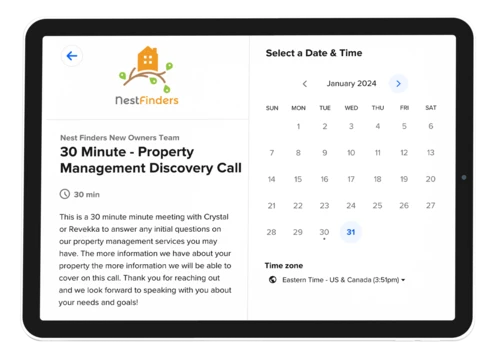

Luckily, Jacksonville property managers can handle security deposits so you don't have to. At NestFinders Property Management, we have the experience to help landlords with full-service property management tasks.

Don't handle your property on your own. Contact us today to learn how we can help.