Investing in real estate is one of the smartest things you can do with your money.

Real estate investments generate an average of $100 billion per year in America alone. By making wise property investments, you can set yourself and your family up for generational wealth. That said, it's not as simple as it might sound.

With today's post, our goal is to help you become a smart real estate investor. Keep reading and we'll explain some real estate basics by looking at 3 key investment strategies you can employ to get your foot in the door.

1. Invest In a Rental Property

The best way to create long-term wealth for yourself and your loved ones is to invest in a rental property. This will give you a regular monthly income that you can set aside to build wealth, which you can then use to invest in more rental properties.

What's great about this investment strategy is that you can write off a lot of the costs associated with it. These include things like insurance premiums, utilities, depreciation, and repairs.

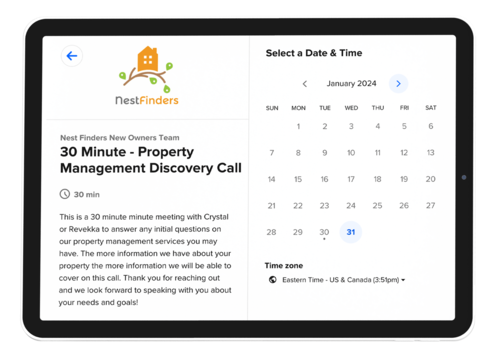

If you're going to find success as a landlord, you need to put the work in, however. Finding great tenants, responding to their requests, and maintaining the home is a lot of work. Many real estate investors choose to hire property management companies to help them with their duties and maximize ROI.

2. House Flipping

The other popular way to get started in real estate investing is house flipping. This involves taking a home in less-than-ideal condition and fixing it up to make a profit. Although this can give you a fast and significant return, there are many real estate pitfalls to look out for.

When investing in a project home, it's important to realize that location matters as much as the house itself. Buying in an undesirable area because it is more affordable may still result in the house sitting on the market for a long time.

If you choose this method, take plenty of time to research the local real estate market. The more work you put into this aspect of the process, the better your outcome will be.

3. Buy Into a REIT

An REIT - a real estate investment trust - is the most affordable way to get into real estate investing. You don't need to come up with a large down payment or look after tenants. Instead, REITs function more like stocks and bonds that you can buy, sell, and trade.

The REIT itself is a company that owns and operates the real estate on behalf of the investors. You don't have to lift a finger, but you'll get a proportionate share of the income from the investment.

Become a Real Estate Investor in 2024

These investing success tips should help you get started as a real estate investor. Whatever method you choose, you may need help with your investment choice. Both landlords and REIT owners need the help of property managers for their investments to thrive.

Nest Finders Property Management is Jacksonville's top option for property management. We've helped countless property investors, house flippers, and REIT owners with property market tips and tricks to maximize their investments. Contact us today to find out how we can help you.