Rent in Jacksonville, Florida, is experiencing the beginnings of a downturn. This is but one piece of the puzzle that landowners should be aware of.

Rental analysis is an essential tool for anyone looking to make informed and profitable rental investments. In essence, rental analysis involves evaluating various factors that influence potential profitability.

Read on to learn about mastering rental analysis and making wiser investment decisions that offer sizable returns.

The Importance of Rental Analysis as a Financial Foundation

Rental analysis is crucial because it allows investors to make data-based decisions. By understanding current rental market trends, investors can gauge demand and set competitive rental prices.

Jacksonville, with its growing population and healthy job market, has many opportunities for rental income. Still, without a thorough rental analysis, investors might miss out on the best opportunities.

Conducting a Thorough Real Estate Market Analysis

Do you want more investment property tips?

Real estate market analysis in Jacksonville involves examining various metrics such as vacancy rates, average rent prices, and trends in property appreciation. By analyzing these factors, investors can pinpoint neighborhoods with the highest rental demand and the best chance for appreciation.

For instance, areas near the city center or close to major employment hubs often have higher rental demand and better potential for rent increases.

Property Valuation Methods for Success in Jacksonville

Accurately valuing a property ensures that investors do not overpay for the property and can project realistic rental income.

Property valuation methods in Jacksonville might include comparing recent sales of similar properties. You can also assess the cost of replacing the property. Don't forget about evaluating the income potential of the property.

Florida Rental Income Strategies

Do you want to maximize profits from rental properties in Jacksonville? If so, investors should also focus on rental income strategies. This involves setting the right rental price, shrinking vacancies, and decreasing expenses.

Setting the right rental price is crucial. If it's too high, the property may remain vacant. If you put it too low, potential income is lost.

By conducting a rental analysis, investors can determine the optimal rental price that balances profitability with market demand.

Maximizing Rental Profits for Floridian Properties

Maintaining the property's condition and responding to all maintenance requests can improve tenant satisfaction. From there, you can reduce turnover rates. Offering flexible lease terms and thoughtful upgrades can also attract better tenants.

Reducing expenses is also vital for maximizing rental income. This can be achieved by negotiating better rates with contractors, using energy-efficient solutions to lower utility costs, and more. Rental analysis can highlight areas where expenses can be cut without compromising the quality of the property.

An Accurate Rental Analysis Can Open More Doors to Profit

With an evidence-based rental analysis, you can ensure that your profits are maximized.

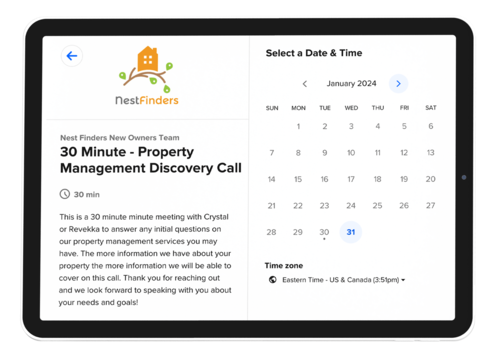

Nest Finders excels in Jacksonville property solutions. You can come to us for financial management, property maintenance, vacancy advertising, and more.

Are you ready to elevate the way your Florida properties are managed? If so, don't wait to discuss the details with a Nest Finders expert today.