There's plenty of discourse on how Jacksonville residents are rent-burdened, but what about property owners? One major factor to consider is the concept of owner disbursements.

Owning rental property can be quite profitable, but it comes with financial responsibilities. It's vital to fully understand owner disbursements and how they affect your finances as a landlord. Read on to learn the details of how it works in Jacksonville, Florida.

What Are Owner Disbursements?

Rental income is the lifeblood of any rental property investment. It's the money collected from tenants in exchange for the right to occupy the property. This income is essential for covering not only owner disbursements but also generating profit for the landlord.

Owner disbursements is a term that explains the distribution of funds from rental income. They're used to cover various expenses related to the property. These expenses may include mortgage payments, property taxes, insurance premiums, maintenance costs, and management fees.

Managing Landlord Finances

As a landlord, managing your finances is crucial to the success of your rental property business.

Owner disbursements play a significant role in this process. They determine how much money you need to allocate for expenses and how much profit you can expect from your rental property.

Navigating Property Management

Property management involves overseeing all aspects of your rental property, including tenant relations, maintenance, and finances. Understanding owner disbursements is essential for effective property management, as it allows you to budget effectively and ensure that your property remains profitable.

Balancing Property Finances

Balancing property finances involves ensuring that your rental income covers all expenses associated with your property while still generating a profit. Owner disbursements help landlords achieve this balance by offering a more realistic view of their financial obligations.

Factors Affecting Owner Disbursements

Several factors can affect the amount and frequency of owner disbursements. These factors include the rental market conditions, the occupancy rate of the property, the terms of any financing agreements, and unexpected expenses such as repairs or vacancies.

Planning for Owner Disbursements

Effective planning is essential for managing owner disbursements successfully. Landlords should create a comprehensive budget that accounts for all expected expenses, including mortgage payments, Florida property taxes, insurance, and maintenance costs. Additionally, landlords should set aside funds for unexpected expenses to avoid financial strain.

Using Property Management Tools

Property management tools can streamline the process of managing owner disbursements and other aspects of rental property ownership.

These tools often include expense tracking, rent collection, and financial reporting. This allows landlords to manage their finances and make better decisions about their properties.

Owner Disbursements Are a Necessary Function of Renting

While owner disbursements are unavoidable, they don't have to take away from all your profit. By maintaining solid bookkeeping, you can ensure you're not paying more than you have to.

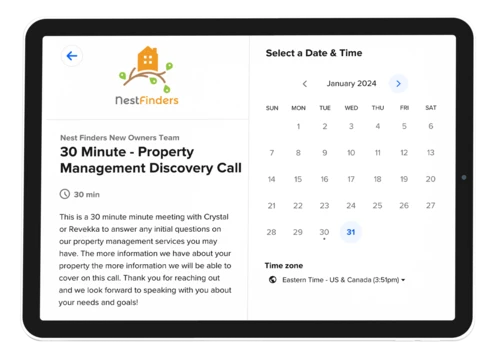

That's where Nest Finders comes in. Our team offers Jacksonville and St. Augustine investors premiere property solutions. We handle finances, tenant screening, maintenance, and more.

Are you ready to get the most out of your Florida properties? If so, don't wait to discuss the details with Nest Finders today.