Rental Market Trends: December 2024 – SPECIAL 3-YEAR DATA REVIEW**

A Message from Our Broker.

Happy New Year! As we closed out 2024 and welcome the first two weeks of 2025, we wanted to take a moment to reflect on the past year and provide you with a special market data review. Over the last three years, we’ve been diligently collecting MLS (Multiple Listing Service) data and have crafted a customized report to analyze the trends that have shaped the market. By closely examining this data, we’ve identified some interesting patterns and shifts that give us valuable insights into how the real estate landscape has evolved. These trends not only help us understand where we've been, but they also empower us to make more accurate predictions about the future. We’re excited to share our findings with you, as we believe they will provide a deeper understanding of the current market conditions. Without further ado, let's dive into the data and explore the key insights that have emerged over the past few years!

Number of Listings: A Clear Trend Emerges

Over the past three years, one clear trend has emerged—one that most of us have anticipated. The number of Active Listings has surged to four times what it was in November/December of 2021. Additionally, we consistently observe a notable increase in active listings during the late fall to early winter season due to decreased demand, with the sole exception of 2021, which was impacted by the COVID-19 pandemic. The data also reveals the typical seasonal dip in total active listings following the November peak, which is common for this time of year—and much needed.

However, this past November was particularly striking, reaching a three-year high with 2,175 Active Listings. This exceptionally high number of active listings should begin to drive listing prices down as landlords and property managers look to fill vacancies. It’s also important to highlight that the number of new listings has been steadily declining over the last five months, contributing to the reduction in overall inventory levels (see the red line in the chart below). Unfortunately, this decline in new listings has not kept pace with the increase in sold listings, which continues to drive the overall active listings higher.

Listing Prices: Stability Amid Challenges

The anticipated drop in "listing prices" has been less pronounced than expected. While prices typically dip during the fall, December—historically the month with the lowest sold median price—was no different, coming in at a median sold price of $1,805. Looking at December 2023, prices were flat with a 0% change. This is actually good news, which contradicts some recent national reports that suggested the Jacksonville rental market was down over 10% year-over-year.

January is expected to maintain similar price levels, with prices likely to plateau and potentially begin rising if historical trends continue into 2025. However, the exceptionally high days on market (DOM) raises questions about how property managers and landlords will react. Will their strategies disrupt the seasonal pricing trends we've observed in the past? Only time will tell. Notably, 2024 saw reduced price volatility compared to 2023, pointing to a more stable market overall.

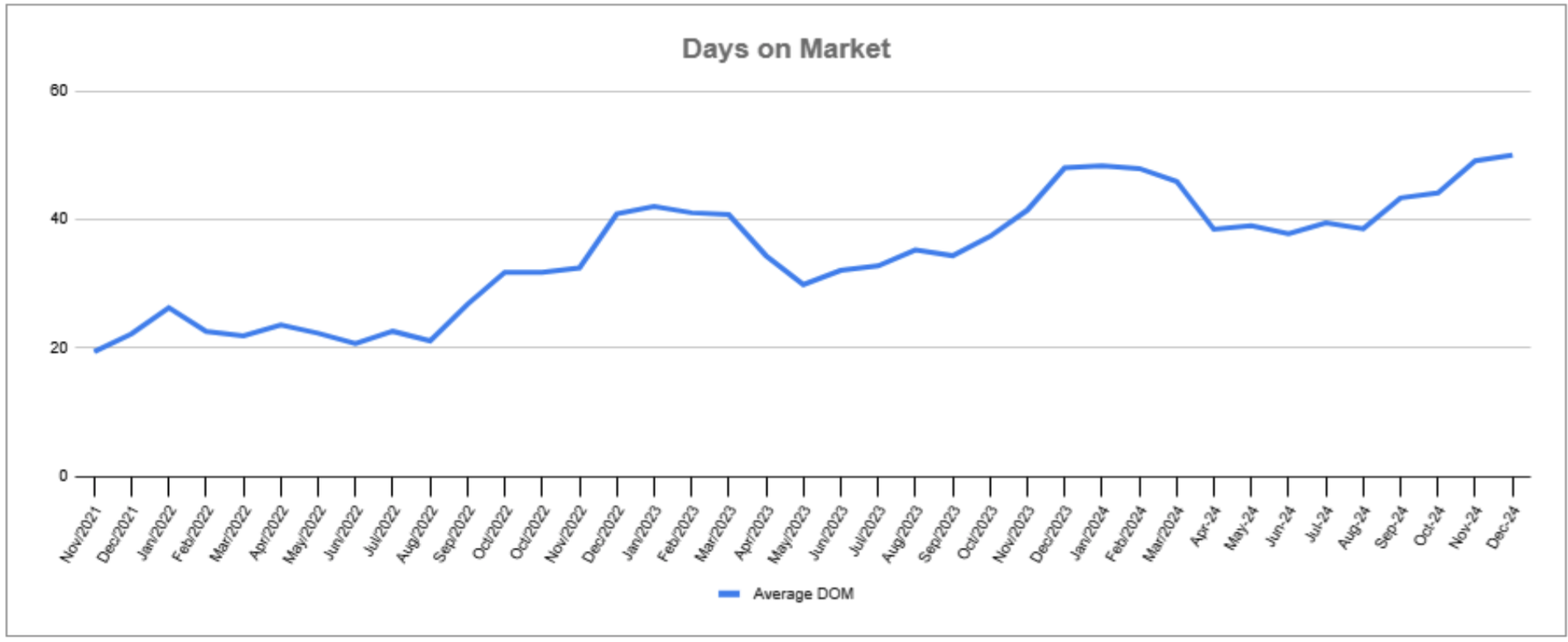

Days on the Market (DOM): A Growing Challenge

Days on market (DOM) has become a significant challenge for many landlords and property managers. Currently, we are experiencing the highest DOM figures in years, with an average of 52.3 days for closed rentals. This means that, on average, properties that have rented out have spent over 52 days vacant on the market. As illustrated in the chart below, this number historically doesn’t begin to decrease until March. Unfortunately, prolonged vacancies can be costly for property owners, leaving price adjustments or enhanced offerings as the primary solutions.

Given these high DOM figures, it’s likely that many investors will lower their asking prices in the coming weeks to secure tenants. While this trend may contradict the current listing price data, it’s reasonable to expect a decline in sold listing prices in the coming months due to prolonged vacancies.

What can you do to reduce DOM? Keep posted for lowering days on market blog this Friday the 17th!

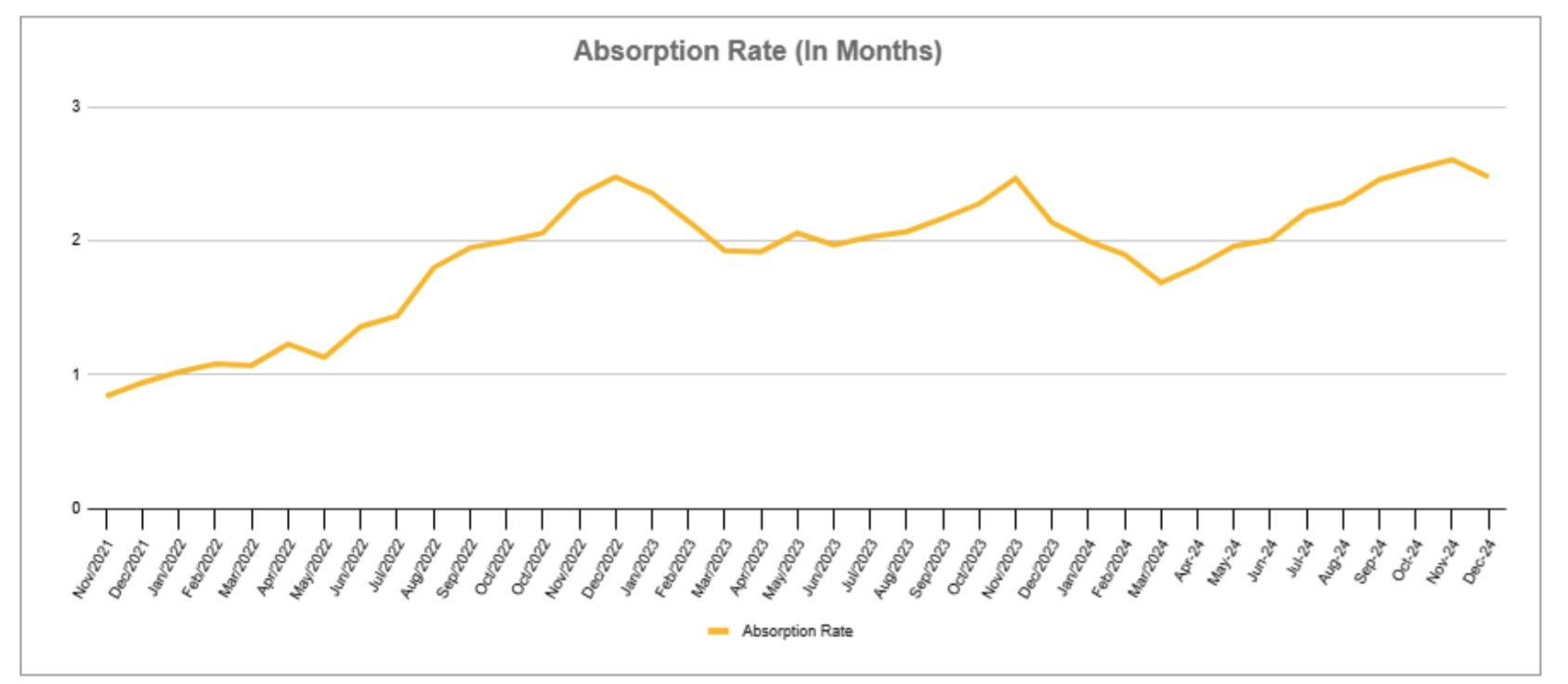

Absorption Rate: A Slow Recovery Ahead

The absorption rate is a measure of how long it would take for the current inventory to be rented out based on the current demand, assuming no additional inventory is added to the market. The 3-year trend below shows the expected seasonal changes but also indicates a steady upward trend. Currently, December saw the second-highest absorption rate at 2.48 months, just behind November’s three-year high of 2.62 months. The good news is that we should start to see an improvement, but we still have a long way to go before we return to the more desirable 1.5-2.0 months range.

Summary: A Market in Transition

The rental market has experienced significant shifts over the past three years. Active listings have surged to four times their levels from November/December 2021. November 2023 reached a three-year high of 2,175 active listings, a figure likely to drive listing prices downward as landlords aim to fill vacancies. Although the number of new listings has declined over the past five months, the decline has not matched sold listings, causing active listings to continue climbing.

Despite this, December 2024’s median sold price remained flat at $1,805, contradicting national reports of a 10% year-over-year drop in Jacksonville’s rental market. While January 2025 is expected to see somewhat more stable pricing, exceptionally high days on market (DOM)—averaging 52.3 days—poses challenges for property managers. Prolonged vacancies may prompt price reductions in the coming weeks, potentially leading to a decline in sold listing prices.

The absorption rate, a measure of how long it would take to rent out the current inventory, reflects these challenges. December recorded a high absorption rate of 2.48 months, second only to November’s three-year high of 2.62 months. While improvements are anticipated, it will take time to return to the desirable range of 1.5–2.0 months.

Overall, the market in 2024 shows reduced price volatility compared to 2023, indicating a more stable but still challenging rental landscape.

**Note:** This data is from the North Florida realMLS, but the opinions shared here are solely mine. I hope this review helps all fellow landlords make better-informed decisions for their rental homes and investments.

Nest Finders Property Management

9889 Gate Parkway N #402

Jacksonville, FL 32246