Are you curious about the health of the real estate market?

Hold onto your seats when you read this number:

The value is soaring past $47 trillion in the U.S. alone. This estimate only accounts for residential real estate, as well. Commercial real estate in the country is sitting comfortably at over $22 trillion.

Leveraging smart portfolio management strategies is the best way to get the most out of this healthy market.

Start With Financial Planning

Set a budget first. Many new investors "bootstrap" their first portfolio. Bootstrapping is a self-financing method where the investor pays for properties out of their own liquid capital; funding could come from paychecks, savings, or other cash reserves.

Loans are the most popular option. The better your credit history, the higher the likelihood of getting approved for real estate loans with generous payback terms and low interest rates. However, there are higher-risk loans for new investors who are just starting to build credit; these loans have higher interest rates.

Investors with lower scores are encouraged to take measures to raise their scores. However, they may also be eligible for higher-interest loans that take collateral like title loans.

You can also assemble an investment group with other new investors to pool funds.

Tips For Diversifying Investments

After settling on a financing strategy, move on to the next step, diversification.

A healthy real estate portfolio will feature a mix of high-performing locations, property types, and income models.

However, this doesn't mean you have to diversify your portfolio with a mix of residential and commercial real estate.

Suppose, you want to focus on rental properties exclusively. You would diversify your portfolio with a range of locations with high rental activity. You could also include apartment buildings, duplexes, and townhomes.

Monitor Your Investment Portfolio

You'll need a good resource allocation strategy that ensures each property receives enough financing. You may have to sell off lower-performing properties to make room for better opportunities. Thus, you'll need to understand the metrics behind assessing real estate performance.

If you have a rental portfolio, you must track the following metrics:

- Tenant acquisition rate (and costs)

- Tenant turnover

- Return on investment (ROI)

- Local market values

- Rental activity trends

- Local economy trends

- Property upkeep costs (including upgrades)

Properties with high turnover rates will require new tenant placement strategies. There may be an issue with tenant screening; leave no stone unturned when acquiring responsible, long-term tenants. You want a high tenant retention rate with low turnover rates.

Portfolio Management Meets Property Management

This next point is crucial. You need a property management company in your corner. You can't manage multiple properties alone, especially if you don't have property management experience.

A full-service agency will handle financials for you, providing a much clearer picture of your acquisition costs, ROI, and profit margins.

Save These Investment Strategies

Never lose sight of your real estate goals. Invest in smart portfolio management. Start with a sound financial plan, practice smart diversification, monitor metrics, and work with a reputable property management company experienced in all areas.

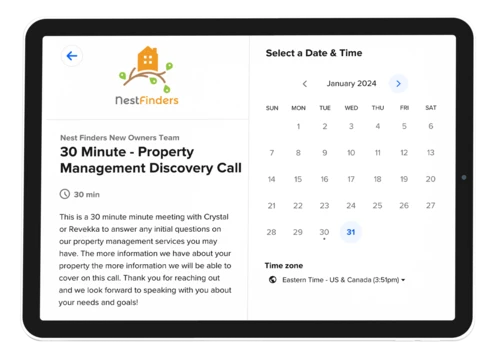

Nest Finders wants to be your property management partner in the Jacksonville area. We're a licensed and insured team of brokers, portfolio managers, sales associates, marketing professionals, and property managers.

Book an appointment to discover the possibilities of your portfolio.